W4 Withholding Calculator 2025. Maximize your refund with taxact’s refund booster. How to calculate annual income.

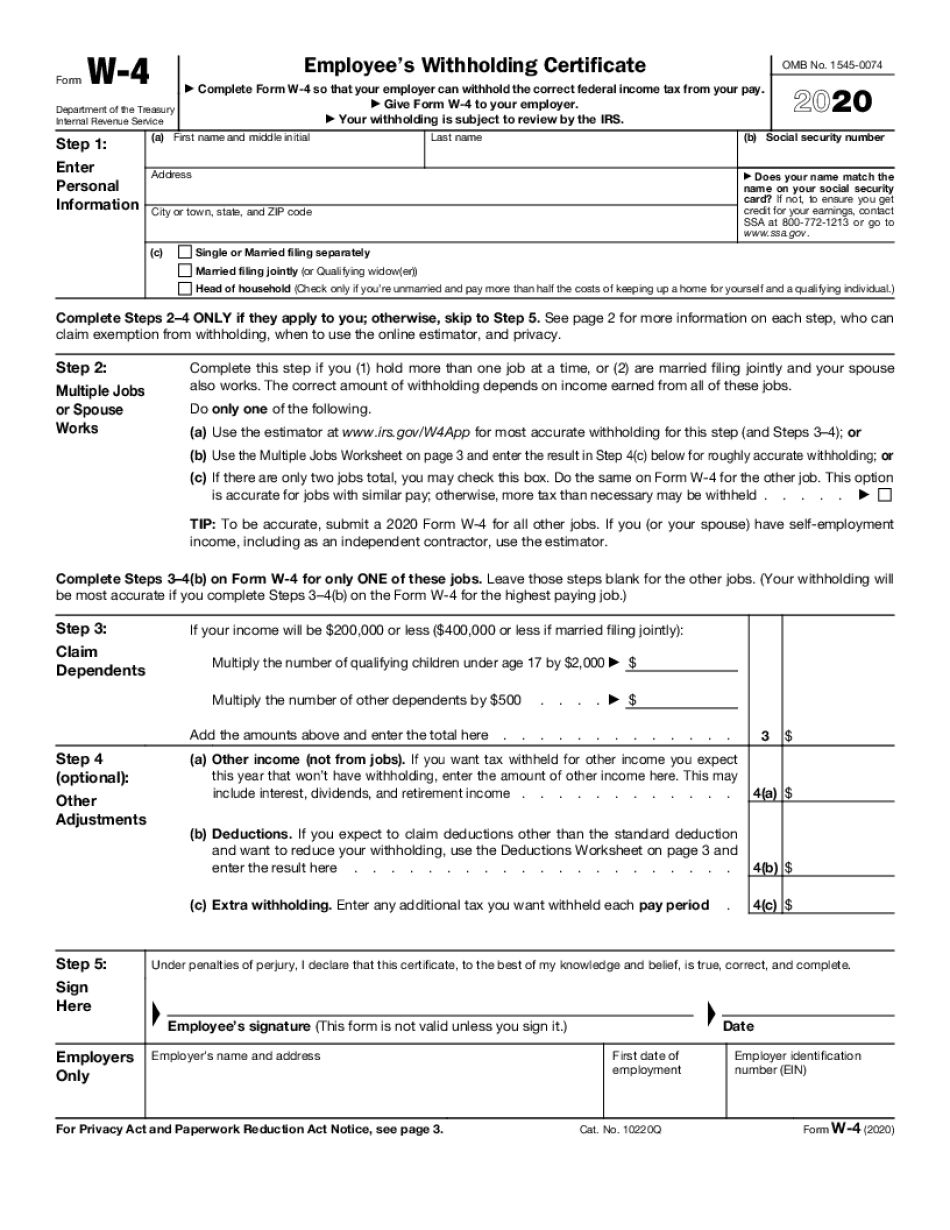

The form w4 withholding interactive form helper takes you through each step of completing the form w4.

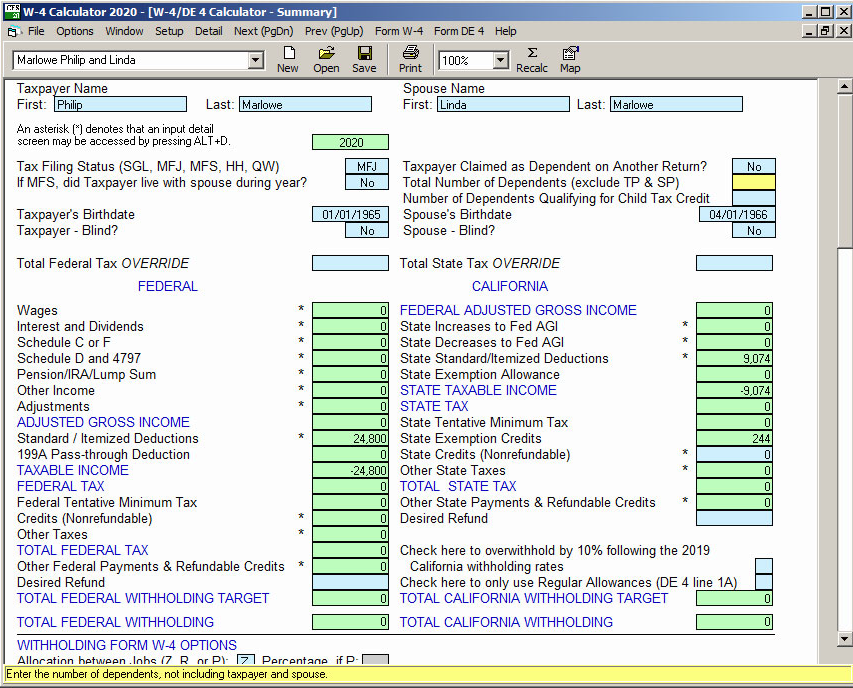

W4 Calculator 2025 I … Elka Nicole, Make adjustments based on your tax goal. After getting a 2025 tax return estimate using the taxcaster tax estimator for the 2025 tax filing season, it's time to plan.

W4 2025 Printable Calculator Idalia Friederike, Use this calculator to help you determine the your net paycheck. Have relevant financial income information such as your paystub and last.

Tax Withholding Calculator 2025 Irs Aretha Marnia, Use h&r block's tax withholding calculator to estimate your potential refund. Our free w4 calculator allows you to enter your tax information and adjust your paycheck withholding to.

W4 Tax Form 2025 Merla Stephie, Fica contributions are shared between the employee and the employer. The following is the formula for each pay frequency:

W4 Form 2025 Instructions In Pavla Beverley, Increase in each income bracket. The following is the formula for each pay frequency:

W4 Form 2025 State Charla Malinde, Our free w4 calculator allows you to enter your tax information and adjust your paycheck withholding to. You can calculate federal or federal and state or federal and state and local withholding.

2025 Tax Chart Irs Wilow Kaitlynn, Our free w4 calculator allows you to enter your tax information and adjust your paycheck withholding to. Use this calculator to help you determine the your net paycheck.

W4 Calculator CFS Tax Software, Inc., Find your state’s w4 forms. The form w4 provides your employer.

W4 Tax Withholding Form 2025 Printable Calley Jolynn, Maximize your refund with taxact’s refund booster. This is our most popular calculator.

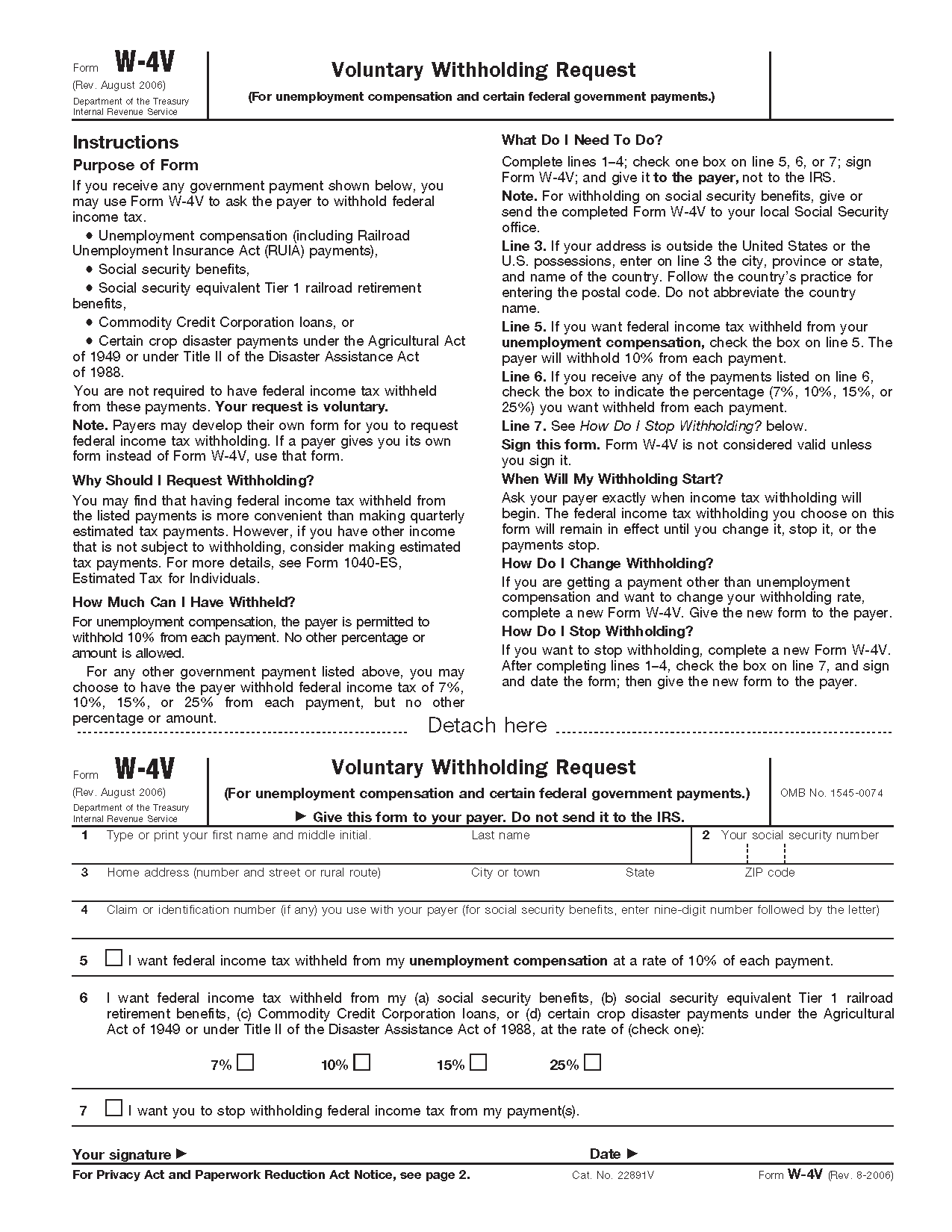

W4p withholding calculator Fill online, Printable, Fillable Blank, You can calculate federal or federal and state or federal and state and local withholding. Here’s how to calculate it:

Our free w4 calculator allows you to enter your tax information and adjust your paycheck withholding to.